New rules of Bank of Baroda: Bank of Baroda has changed some of its rules. If you are a Bank of Baroda customer then this news can be useful for you.

Because, from the coming February 1, the new rules are going to be implemented. If you are not aware of the new rules, then there may be problems in the functioning of the bank.

From February 1, the rules related to check clearance (positive pay confirmation) of Bank of Baroda will change. According to the new rules of the bank, confirmation will be mandatory for check payment from February 1. To happen again. These rules will apply to checks of an amount of 10 lakhs or more.

Bank's Appeal

The bank has appealed to the customers to avail the facility of positive pay for CTS clearing. The bank has made this rule to avoid fraud in checks. The bank has said that protect yourself from fraud by re-verifying the details through various channels.

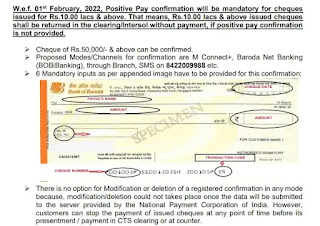

Bank of Baroda has given the facility of virtual mobile number 8422009988 for positive pay confirmation. After writing the CPPS, confirmation can be made by sending it to 8422009988 with Account Number, Check Number, Check Date, Check Account, Transaction Code, Name of the Recipient. Apart from this, calls can be made on toll free numbers 1800 258 4455 and 1800 102 4455.

What is check positive pay system

New security measures are introduced from time to time by the Reserve Bank of India to prevent incidents of bank related frauds. A new system was introduced to prevent incidents of counterfeiting through bank cheques. The new system is the Positive Pay System (Positive Pay Confirmation) for cheques. It was implemented in the country from January 1. Many banks have made this system effective.

Bank will have to give full information

When someone issues a check under the positive pay system, he/she has to give full details to his/her bank. This will include the issuer of the check electronically through SMS, Internet Banking, ATM or Mobile Banking, date of the check in whose name the check is issued, bank account number, amount of the check and other necessary information. be given to the bank. With this system, while the payment by check will be secure, the withdrawal will also take less time.

The check issuer can provide all these information through electronic means such as SMS, mobile app, internet banking or ATM. These details will be cross-checked before check payment. If any discrepancy is found, the bank will reject the check.

.jpeg)

.jpeg)

0 Comments